Gibson creditors want new CEO before offering a rescue deal – Bloomberg

Machinations continue in the run-up to debt repayment deadlines

Bloomberg has reported that a group of Gibson’s creditors want a new CEO installed before they offer a rescue deal to the floundering American guitar giant.

Rescue Deal

Financially, it’s been a horrendous couple of years for Gibson USA. The once-great American guitar maker is in serious trouble. Now Bloomberg has reported that a group of bondholders advised by PJT Partners Inc are pushing for a new leadership at Gibson as a precondition to offering it a financial lifeline. Bloomberg says these bondholders control more than two-thirds of Gibson’s outstanding notes. If they get their way, we could see the departure of CEO Henry Juszkiewicz and his top-level management.

Custom Shop Layoffs

This news comes after the Nashville Post this week reported that 15 senior staff, including supervisors, at Gibson’s Custom Shop were laid off on Monday. This is probably part of Henry Juszkiewicz’s cost-cutting plan to be able to refinance the debt in July. That’s not good news, by any measure.

Gibson’s CEO has also been quoted recently proffering his opinion that the decline of sales is more to do with the way guitars are sold by retailers rather than issues or decisions for which Gibson is responsible. In this article in Music Instrument News, he blames retailers for the decline in guitar sales.

‘”All of the retailers are fearful as can be; they’re all afraid of e-commerce, with Amazon just becoming the second largest employer in the US, and the brick and mortar guys are just panicking. They see the trend, and that trend isn’t taking them to a good place, and they’re all wondering if there will be a world for brick and mortar stores for much longer. It’s a turbulent world to be a retailer, and many of our retail partners are facing that same issue.”‘

Purists

He also blames “purists” for being “stuck in a time warp” in terms of the guitars they buy and has been trying to justify modern innovations and stylings which like the Firebird X, Robot Tuners:

“[The industry is] stuck in a time warp, and the ‘purists’ have a very loud voice on the online forums. If you are a kid today, you have an iPad by the age of two, and if you’re not offering new technology you’re old. Kids today may think some music from the 50s is kind of cool here and there, but what other industry do you know that hasn’t changed since the 50s? Those guitars from the 50s are what the purists want, but we have to have something new and exciting. Imagine if the camera had never changed. Innovation is a part of every business to some degree, but [the guitar industry] hates it. The kids demand it, and if you don’t have it, they walk.”‘

Death Of a Giant

Let’s be clear that the previous owners, Norlin Group, didn’t exactly do Gibson any favours. When Henry and his group bought Gibson from them in 1986, it was a case of rescuing a dying giant.

But 32 years later it would appear that the vultures are circling once more. Now, Henry is no Steve Jobs. Yet he seems to think that somehow he can do for Gibson what Jobs did for Apple. I beg to differ. I feel that he’s steered the company into financial difficulties by not listening to what the players actually want.

Video

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

25 responses to “Gibson creditors want new CEO before offering a rescue deal – Bloomberg”

Rumors from here on the west side of the pond have Yamaha, Shiro Ari, Hartley Peavey, and a unnamed Chinese financial consortium sniffing around Gibson. Looks like things are getting lively. Money here says this show is just getting started. Cheers, mates.

Yes, I have heard the Yamaha rumour myself and it kind of makes sense, as they take time to develop and support their products. Rather than dishing out gadgets that nobody actually wants.

Wait, so blaming everyone and everything but himself and firing a handful of people didn’t magically fix all the problems??

I’m shocked.

Funny that…

He seems to have an answer for everything.

I really hope they get him out, he hasn’t got a clue… also, never realised until this video that he can’t play for shit and has the most dreadful tone!!!

“Putting his musical skills to work, he worked his way through school playing guitar – a Gibson, of course – in various rock bands playing for parties and weddings”

Taken from his own Corporate Press Release here

http://archive.gibson.com/Press/press_juszkiewicz.asp

I’d love to know what they were taking at those parties, that they got Henry to play music for them!

Obviously not quite as bad of drugs as what the marketing dept. at Gibson must be on to release a “Kermit The Frog” green J45 and a “Pretty In Pink” Hummingbird:http://www.gibson.com/Products/Acoustic-Instruments/2018/J-45-Neon-Green.aspx

http://www.todayifoundout.com/index.php/2011/03/the-inventor-of-the-legendary-fender-guitars-never-learned-how-to-play-guitar/

This guy is a schmuck. Huckster City. Believes his own balogna. Can’t play. Can’t keep one of the most iconic and important musical instrument manufacturers breaking even at the least.

Get him out.

Please check my article regarding Gibson on my Linkedin profile. This is a response to all statements made by Henri Juszkiewicz. http://linkedin.com/in/wilbert-kieboom-20253830

kieboomps://www.linkedin.com/pulse/gibson-what-wrong-wilbert-kieboom

Article by Wilbert Kieboom:

In August 2017 I wrote about the fact that over the past three years, Gibson’s annual revenue had fallen from $2.1 billion to $1.7 billion, according to data as reflected by Music Trades magazine and internet publications. The company’s 2014 purchase of Philips’s audio division for $135 million led to debt — how much, the company at that time did not want to say — and further there was a Moody’s downgrading last year. Recently we have seen further down grades of big players such as Gibson based upon their performance with a lot of rumours.

As an experienced ex CEO out of the IT industry and currently owner and founder of a Guitar Boutique and manufacturer of “String Wood Custom Guitars & Amps” in The Netherland, I would like to add my five cents worth of what I think is wrong in the strategy of large guitar manufacturers and retailers and especially Gibson. My current company String Wood, specialises in Custom build Guitars & Amps, Pedals and hand made Guitar Straps. Next to Guitar Building & Design, we are the European Service Center of B&G Guitars in Europe. Prior to this I spend 25 years in the IT industry, that has proven to be an industry that is usually years ahead of most other industry trends and I can safely say that my ex IT industry colleagues and myself have been there, learned to accept that our product lines are constantly under pressure with heavy competition and learned to adapt to these changing circumstances already years ago.

First of all the product portfolio of many vendors such as Gibson is facing a situation whereby off shore manufacturing is leveling the playing field to all large manufacturing guitar companies competing for the same space in the low end and volume market space. They all offer similar products, through the same OEM manufacturers with comparable quality. I personally get offers from companies in China that claim they produce for the big players as well with squeezed out margins and I must add that they offer products at very low cost. They also claim they can manufacture the same products for any one asking and they do, even if that brings them in difficulty! The quality of these products and the specs is marginal at best. Often in their products, I find cheap hardware, cheap wiring and pickups, lesser quality tone woods, that certainly do not warrant a high end quality product price and offer very little differentiation. These days you can find computer PCB’s and light weight, “unobtrusive tuning systems” in the cheaper Gibson guitars as well as built in overdrive systems (an internal (!) analogue overdrive pedal incorporated into a classic ’50s single cut guitar design) that serious musicians have no use for. So why do it? These are just a couple of examples. Many manufacturers according to my opinion, have been competing for a long time in the valley of death due to failing business strategies, with defunct Product Development and lacking Sales & Marketing programs!

To explain what I mean with the valley of death, I always draw the market in a U shape, i.e. you either decide you will pursue the volume market on the one end of the U spectrum or you choose the value add spectrum at the other end of the U. Trying to do both will land you in the middle or bottom end of the U curve , i.e. the valley of death, because you don’t succeed in either strategy. It seems difficult for players like Gibson to make a choice here. Their Custom Shop is overpriced and their volume business competes with all other large manufacturers that have found the way off shore. The 30% price increase a couple years back with a change of a logo looking like it was designed by a child and forcing large volumes on the retailers did not help either and was a sign they were desperately searching to improve their business.

Having said this, while searching for the right direction, large players like Gibson have decided to “limit” their channel by demanding high buy in volumes from their retailers in the sense that volumes are dictated and forced upon their channel partners (Channel Stuffing we used to call this). Channel stuffing or full warehouses leads to price erosion, which leads to low or no margin. No or little price protection brings retailers into difficulty, which is why they “dump” prices. Just watch the “SALE” activity with some of the retailers out there which is almost a continuous activity?! They are not doing this to do you a favor, but it is born out of strict necessity to maintain a proper cash flow and to pay the bills. On top of that, the large guitar manufacturers including Gibson further force concern products on their channel partners by mixing the buy in requirements of low cost and high end products and are giving their channel partners no choice in allocation. The IT sector used to do this in the 80ies and 90ies, “Take their money, Take their brains and Take their warehouse” was the directive. Imagine the clothing industry trying this. They would be out of business in no time. Their current channel partners are predominantly box movers with limited or no marketing “attention” or knowledge and love for their products and operators that whore themselves to any Manufacturer that moves stock. They go from sale to sale and deteriorate the business for the entire channel. It is therefor not difficult to imagine why these same retailers often find themselves getting into financial difficulty and when that happens the chain is broken. The smaller retailers are pushed out by the big guitar manufacturers and eventually disappear while the large box movers move from one deal to the next whoever offers their products the cheapest and compete each other to death with automated agents that monitor pricing and adjust automatically to be the lowest bidder. Again for these retailers a road to a slow death and bankruptcy because you have to make a sustainable margin to stay healthy as a business.

Only the high end boutiques locally survive and offer often superior luthier products, build in the way that top guitars should be build in the first place. These same high end boutique’s clearly choose for the “Value add” strategic option, refusing to sell products at a loss and they don’t have to as they offer service and quality that is in demand. Serious guitar players now days care less about the brand then they do care about quality.

The Gibson problem is not complex. It is still a fantastic brand, with a great legacy and potential. However pricing and production options need to be reviewed, the Custom Shop needs to stay in a adjusted fashion. Channel strategy and basics need to be reinstalled with better and different sales tactics. Instead of limiting the channel, the channel needs to be expanded with far more flexibility. The Direct internet selling model needs to be revisited and should only be implemented for the lower cost models and not the value ad high end gear. Marketing and Communications need to receive a serious boost, also entering the digital media area big time. Management needs to be closer to their clients and musicians. Management needs to be given a serious boost and upgrade. So get with the modern times guys!

So the moral of the story is that the strategic options should be reviewed again as should be the channel strategy and a financial redesign is needed. My advise would be to acquire some knowledge from other industries with people that have been there. People that solved these common errors and problems before with success. Time is ticking ~ Good Luck because I want you to survive!!

Written by Wilbert Kieboom

Hes got to go.

I love Gibson guitars and I’ll be sorry if they go out of business.

More bad news about Gibson as it is reported that Gibson is now planning an overall 12-15% cut/reduction of their workforce.

I’m upset with Gibson for flooding the market with guitars containing non value add features that no one wants to buy and increasing prices. Not a very “Steve Job” move for this self proclaimed innovater CEO. He should have been fired a long time ago.

Well said, Trevor! I to don’t care for any of that new-fangled junk either and yes, Henry should’ve been fired a long time ago.

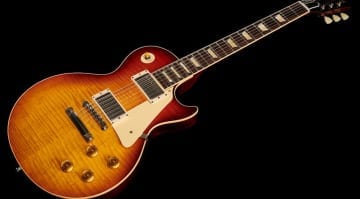

I also don’t care for the Swiss-cheese weight relieving of their Les Paul line. I have a ’73, ’75, two ’77s and a ’79 all of which weight a ton but the tone is awesome. The weight relieved Les Pauls to me just sound a bit anemic and weak. Gibson claimed that was a “customer driven issue” but in over 36 years of playing guitar I have yet to come across anyone who asked for that!

Regarding the Les Paul “weight” issue, it has been recently reported by reputable sources like luthier John Suhr that most if not all of the “light” 50’s ‘Bursts’ were NOT made with Honduran Mahogany but actually made with African Mahogany (Khaya) which generally runs much lighter and that documents exist at Gibson to verify that. So the Les Paul “weight” issue could have been easily solved without turning the guitar into a “semi-solid” as nobody has ever accused “50’s ‘Bursts’ of being “anemic” or “weak”.

That’s right, Henry, blame everyone except yourself – including your customers. 1) The Robo Tuners did not work well. 2) The quality of the materials lead to guitars that did not stay in tune (thus needing the Robo Tuners that didn’t work). 3) Those nice looking new guitars probably weren’t given much of a chance because they were either over priced for the quality or just not as nice as you thought!. Other companies make equal or better quality guitars for about half the cost, sometimes one quarter the cost of the current generation Gibson guitars – or at least the handful of Gibson guitars I’ve looked at. But what do I know, I play keys.

I agree 100%; “King” Henry has to go! He did a lot of good for Gibson when he took over from the awful Norlin years but here in the last couple decades he seems to be more lost than a blind man in a blizzard and hasn’t got a clue as to what to do about it. What further compounds this is he’s blaming everyone else except himself for Gibson’s falling popularity.

I sincerely hope Gibson weathers this storm and rises like a phoenix from the ashes stronger than before but if they don’t run Henry Juszkiewicz off, throw all that garbage he came up with out the door that NOBODY wants, overhaul their quality department and return to what made Gibson great in the first place Gibson is doomed!

OMG, I play guitar WAY better than this fool, and I suck at guitar!

Just make great Gibson guitars that are affordable! Not $3800 for a 335!

That video of him playing backstage leads me to believe he will live a very fruitful life as a studio musician and rockstar.

A couple of thoughts on the Gibson mess. One of the reasons Gibson is having problems refinancing their debt is that their debt-to-earnings ratio is 10x and in the US banks are not allowed make loans when the ratio is over 6x so Gibson has to try to do it thru bonds which are generally more expensive. Currently I believe Gibson is paying 8.75% on the bonds they have (the ones coming due this summer). Also it has been reported that the creditors have engaged Japanese attorneys to ascertain whether Gibson’s Japanese companies like TEAC (which is a publicly traded company in Japan) are subject to 3rd party claims in the event of a bankruptcy.

Henry Juskiewicz Needs to be removed as CEO, before he totally destroys Gibson . Absolutely clueless and lack of vision, as to what direction the company needs to go. With his ridiculous auto tuning every guitar as so called moving forward with the times . omg what an idiot ! Not listening to his customers , never mind all the artists who have left and are leaving Gibson.

Let Peavey or Yamaha with rumoured Joe Bonamassa also to bid for the company lead Gibson with tradition, craftsmanship , quality and bring treasured Gibson company back to Standard !

God Bless Gibson……

Good luck Guys…

Gunars

You are currently viewing a placeholder content from Facebook. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information